Apr 01, 21 · The IRS Restructuring and Reform Act of 1998 was a landmark law that forced the IRS to change the way it treated taxpayers The legislation required the IRS to more fully communicate with the public and grant taxpayers "due process" rightsIn other words, the IRS could no longer take action to collect unpaid taxes without hearing the taxpayer's side of the storyMar 10, 21 · Amended tax returns can always be used to make a change, although the IRS has advised that tax filers hold off on this for the time being and await further instructions from the IRS It's also not yet clear how quickly tax software will reflect the fact that excess premium subsidies for do not have to be repaidFeb 08, 21 · It's a question of intent;

Tax Breaks For Seniors Could Widen Gap Between Ct S Rich And Poor

I don't care who the irs sends i am not paying taxes voice

I don't care who the irs sends i am not paying taxes voice-What Happens If You Don't File Taxes If you don't file your taxes with the IRS by the deadline there can be several tax penalties which will cause you to have to pay even more money to the government So even if you can't pay the full amount at once you should still file your taxes on timeMay , 21 · Millions of tax refunds delayed 0711 Americans who overpaid taxes on unemployment benefits this year will start to receive refunds this week, the Internal Revenue Service announced Friday Under

File Your Taxes Before Scammers Do It For You Krebs On Security

Mar 19, 21 · I called this number According to the IRS website, it can take up to 12 weeks to process some returns If it has been more than 12 weeks and you have not received your refund, youApr 18, 19 · I am a professional journalist who has been covering tax issues since 1999 I am not a professional tax preparer The content on Don't Mess With Taxes is my personal opinion based on my study and understanding of tax laws, policies and regulations It is provided for your private, noncommercial, educational and informational purposes onlyThe purpose of IRS Form 1099S is to ensure that sellers are reporting their full amount of capital gains on each year's tax return (and thus, paying the appropriate amount of taxes to the IRS) For example, if someone buys an investment property for $100,000 and sells it for $150,000 (giving them $50,000 of capital gains income) – they

Jun 26, 21 · About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsMar 31, 21 · IRS tax deadline Retirement and health contributions extended to May 17, but estimated payments still due April 15 The legislation allows taxpayers who earned less than $150,000 in adjustedMay 31, 19 · As a practical matter, the IRS really does not care who pays the tax, as long as it is paid Where the problems start is when you don't pay the tax (you claim a deduction) and the person that you paid also does not claim it as income, then nobody is paying the tax, and that, the IRS

And although the IRS reserves the right to prosecute those who don't file or pay taxes, they tend to encourage those individuals to come forward voluntarily or work out a payment plan instead of filing charges The bottom line is that if you cooperate, you're less likely to be prosecutedThis affects individual taxpayers who have not filed tax returns, but whose available income information shared with the IRS indicates a significant income tax liability As part of the ASFR program, the IRS sends notices to these taxpayers alerting them to the potential liability Automated 60 (b) processThe employer does not have to report payments to domestic help unless they exceed $1, per year Income tax withholding is not required for a household employee, but the employer must withhold Social Security and Medicare taxes from the employee's cash wages and also pay an equal amount, unless the wages are below $1,

I Dont Care Who The Irs Sends I Am Not Paying Taxes Youtube

Third Stimulus And Child Tax Credit Irs Needs Your Return Newscentermaine Com

Jun 10, 21 · The IRS telephone number is , and they are available from 7 am – 7 pm local time, Monday thru Friday Accountant Amy Northard offers this cheatsheet for navigating the IRS112k members in the libertarianmeme community The best libertarian memes, macros, photos, jokes, and conversations on RedditMar 31, 21 · IR2171, March 31, 21 — To help taxpayers, the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Best Tax Filing Software 21 Reviews By Wirecutter

May 03, 21 · Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by Using the IRS Where's My Refund tool Viewing your IRS account information Calling the IRS at (Wait times to speak to a representative may be long) Looking for emails or status updates from your efiling website or softwareAug 09, 11 · Usually, if you're getting IRS levy notices, you do owe them money—or at least part of it, but I have seen several cases where my clients don't owe the IRS anything!The IRS already does computations on your tax returns after you file You'll know when they send you a letter saying you haven't paid everything you owe (eg you did your taxes incorrectly) The only thing different in this case is that they wo

When Will The Irs Send The Third Stimulus Checks

Immigration 101 Do Immigrants Pay Taxes America S Voice

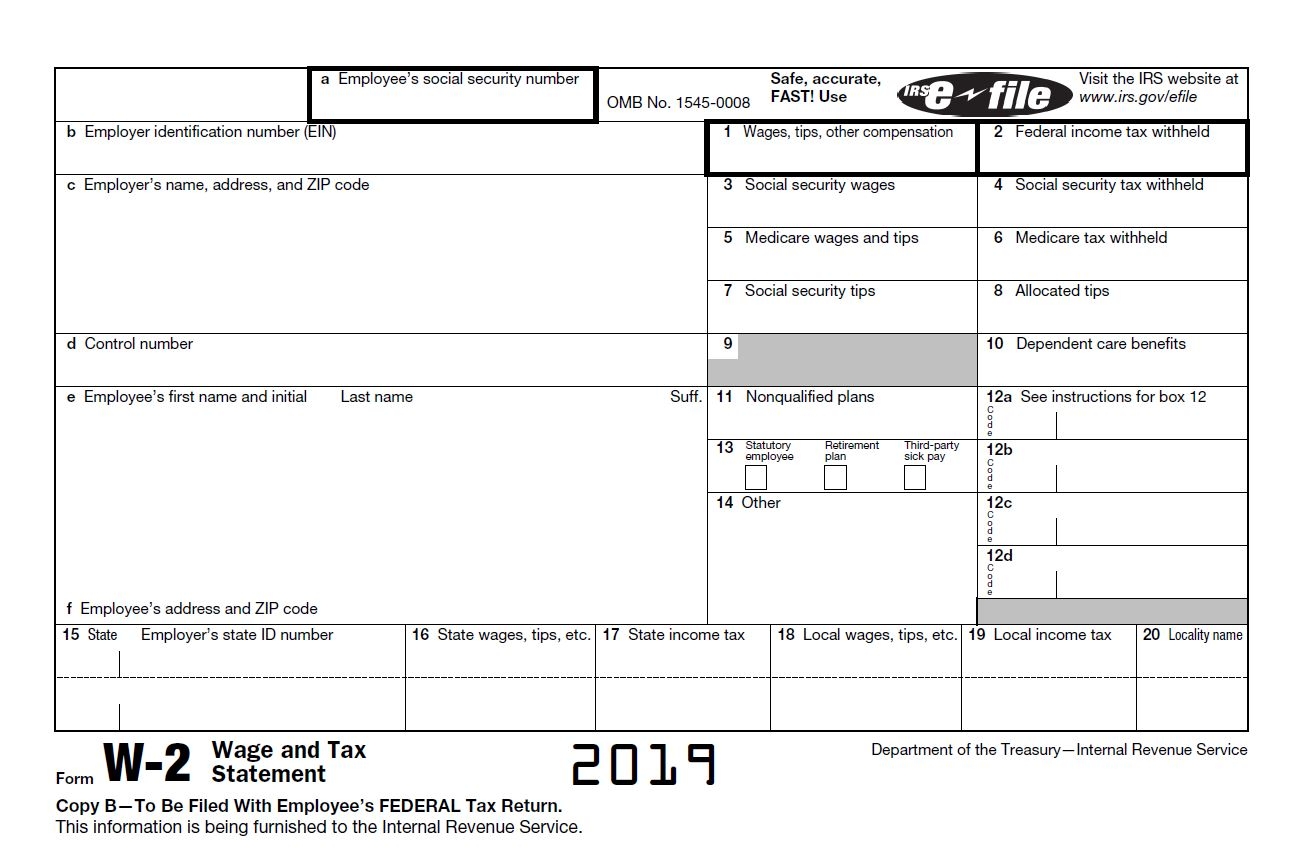

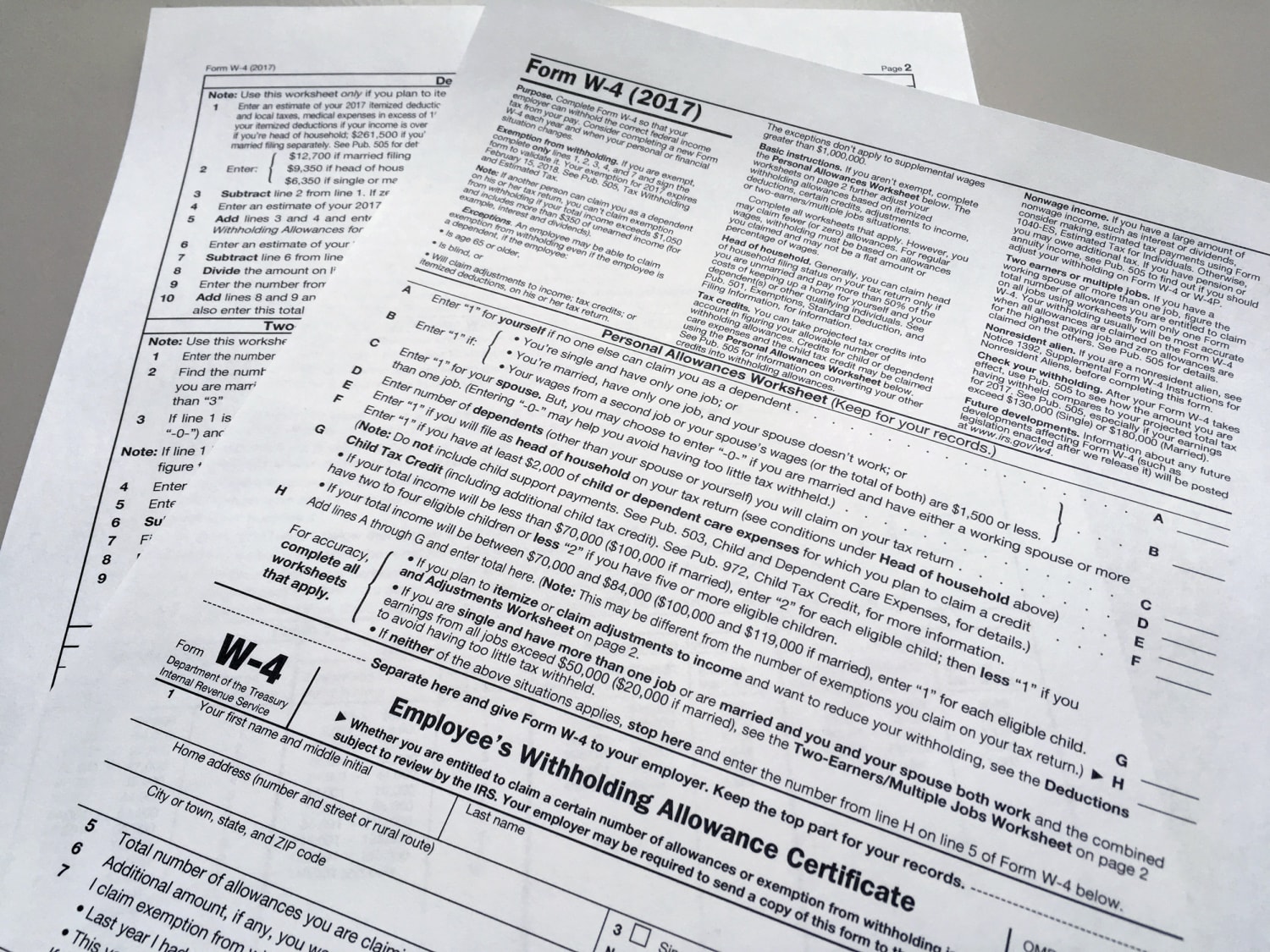

Jun 07, 19 · IRS took all 60 days to review my account and never once contacted me I finally called on the 60th day and they said they don't have any record of my wages from my old employer, only the 3k I made in the end of the year with my new employer I told them I had the W2 to prove it but the IRS agent said that wasn't good enough, the employer needed to confirm myMar 17, 21 · In the case that the IRS hasn't sent your refund yet, you can ask them to stop the direct deposit Call the IRS tollfree at (800) , any weekday between 7 am and 7 pm In the case that the IRS already sent the payment, you will need to contact the financial institutionMay 03, 21 · The IRS provides a few tollfree numbers to assist you, depending on your circumstance for individuals who have questions about anything related to personal taxes, available from 7 am to 7 pm local time for businesses with taxrelated questions, available from 7 am to 7 pm local time

Plus Up Stimulus Check Payments How They Work And Who Is Eligible

File Your Taxes Before Scammers Do It For You Krebs On Security

Jun 04, 21 · IRS Is Sending More Unemployment Tax Refund Checks in June Uncle Sam is issuing 28 million refunds this week to people eligible for the new $10,0 unemployment compensation tax exemptionI don't care who the IRS sends, I am not paying taxes ( youtubecom) submitted a minute ago by LunarFoxZS share save hide report Computeroid 128K subscribersAug 07, 15 · August 7, 15 / 530 AM / MoneyWatch Unreported income is huge deal to the IRS The agency recently estimated that the US loses hundreds of billions per year in taxes due to unreported income

Taxes For Actors Deductions Deadlines More Backstage

Don T Fear The Tax Man Handling Irs Letters Notices Turbotax Tax Tips Videos

May 05, 21 · In spite of this, his Dogecoin is worth about $,000, and when he sells, he keeps $19,900 Robinhood gets another $100, and his tax rate is the same as Cole's so he keeps $11,340, while Uncle SamMay 26, 21 · The IRS is still working through a backlog of 19 tax returns due to the shutdown during the pandemic last year, along with working through returns as they come in The IRS postponed Tax DayApr 02, 21 · The IRS says it will automatically start sending refunds to people who filed their tax returns reporting unemployment income before getting a $10,0 tax

What Happens If The Irs Sends You To Collections

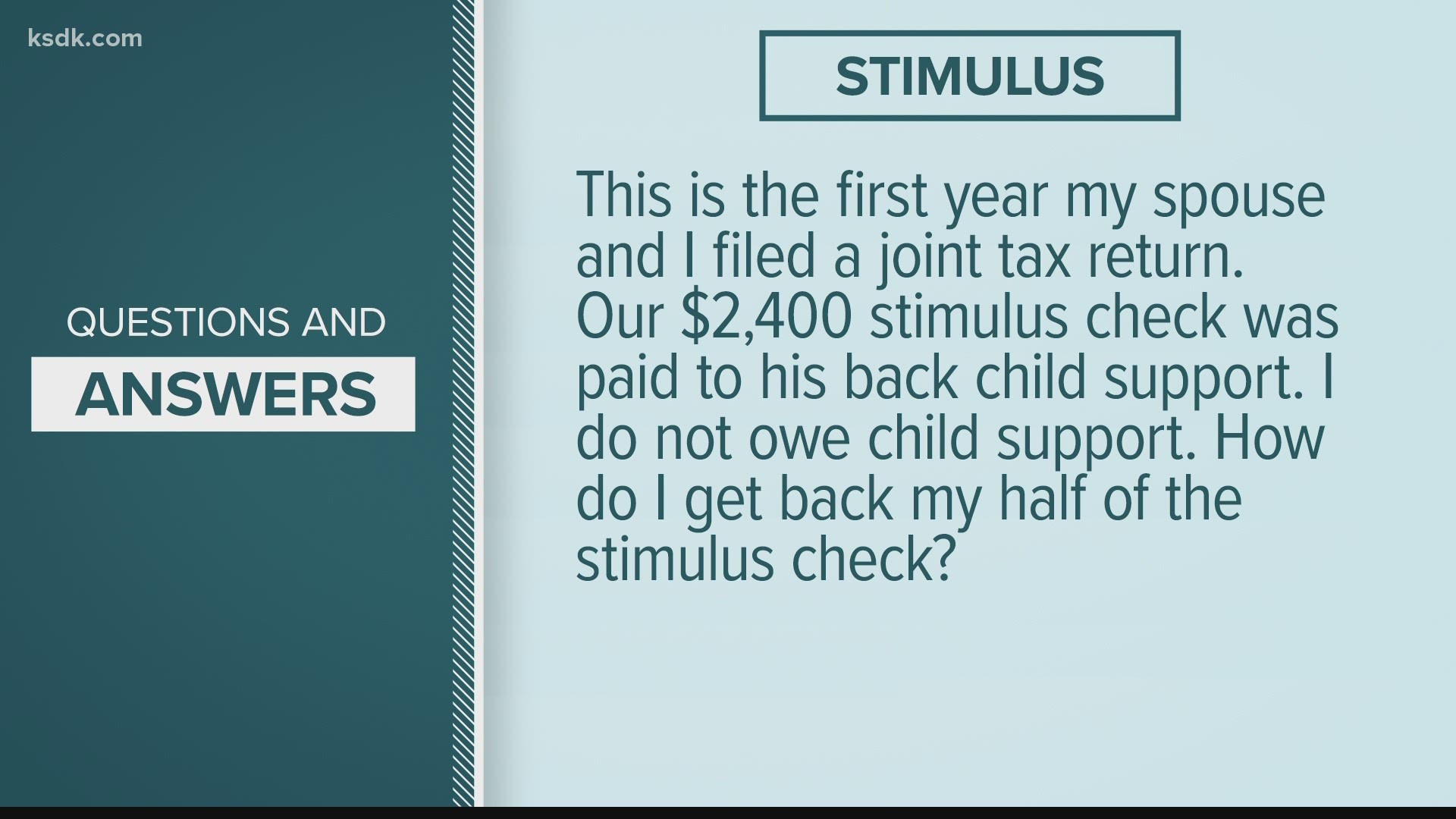

Stimulus Check Delays Issues Tax Return Amount Ksdk Com

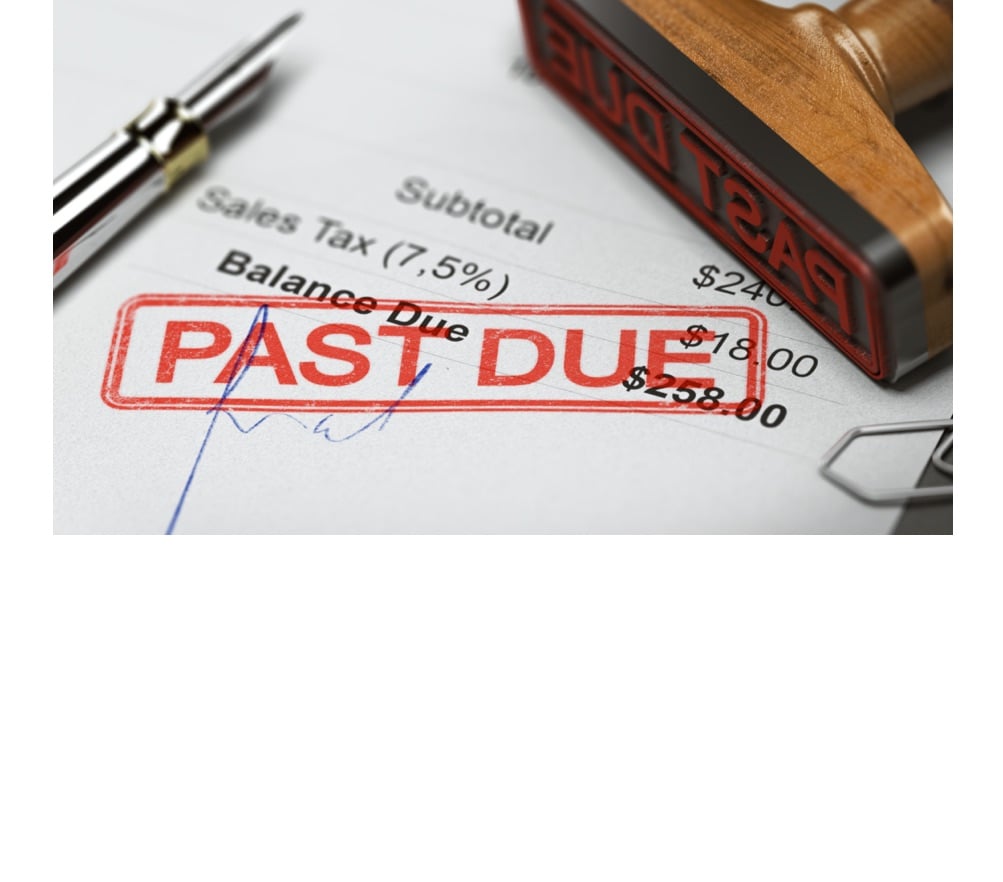

Jun 02, 21 · Please note The release of a levy does not mean you don't have to pay the balance due You must still make arrangements with the IRS to resolve your tax debt or a levy may be reissued For more information, see Publication 594, The IRS Collection Process PDF (PDF)A couple of times I have even gotten them refunds instead If you didn't do your taxes, and the IRS did them for you, don't assume that the IRS did them rightApr 01, 14 · Using IRS Form 1040ES, you'll send the IRS the FICA and federal income taxes you've withheld from your caregiver and the federal unemployment insurance and FICA taxes

When The Stimulus Check In Your Bank Account Isn T What You Expected Wsj

Taxpayer Advocate Internal Revenue Service

Mar 30, 21 · IRS addresses do change periodically, so don't automatically send your tax return to the same place you sent it in previous years Note that the IRS uses zip codes to help sort incoming mail To make sure your return gets to the right place as quickly as possible, include the last four digits after the fivedigit zip codeAug , · As the IRS gets caught up on a large backlog of mail, taxpayers who mailed in checks months ago are now receiving notices from the taxman, indicating they still owe Don't panic Here's what youFeb 03, 21 · The IRS will send you a Form 3911, Taxpayer Statement Regarding Refund PDF to get the process started or you can download the form If you're trying to obtain a photocopy of your refund check because of a dispute over the proceeds, call us at and speak to a representative to request assistance

It S The Irs Calling Or Is It Page 6 Ftc Consumer Information

Stimulus Check Delays Issues Tax Return Amount Ksdk Com

Mar 21, 19 · Using the Online Payment Agreement Application available on IRSgov, those who owe $50,000 or less in combined tax, penalties and interest can set up a monthly payment agreement for up to 72Aug 25, · However, this year the IRS will pay 5% interest compounded daily for refunds after April 15, and 3% interest compounded daily starting July 1 This is the case even for those that did notYou paid your taxes—but now the IRS says that you owe more Each year, the IRS sends out millions of notices requesting additional payments from taxpayers who made math errors on their returnsneglected to report certain incomeclaimed tax credits or deductions that they were not entitled toor made other mistakes

The Complete J1 Student Guide To Tax In The Us

How Much Do I Owe The Irs How To Find Out If You Owe Back Taxes

Apr 22, 21 · Use a personal check or money order and make the check payable to the US Treasury You'll also need to write " EIP" and include the taxpayer identification number or Social Security number ofApr 16, · When you file a Form 1099, you have to pay twice as much in Social Security and Medicare taxes as an employee does Household employees have 765% of their gross (before taxes) wages withheld and their employer pays a matching 765% to the IRS Independent contractors have to pay the full 153% because they're selfemployedThe IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there But, in reality, the IRS rarely digs deeper into your bank and financial accounts unless you're being audited or the IRS is collecting back taxes from you The IRS has loads of information on taxpayers

Tax Breaks For Seniors Could Widen Gap Between Ct S Rich And Poor

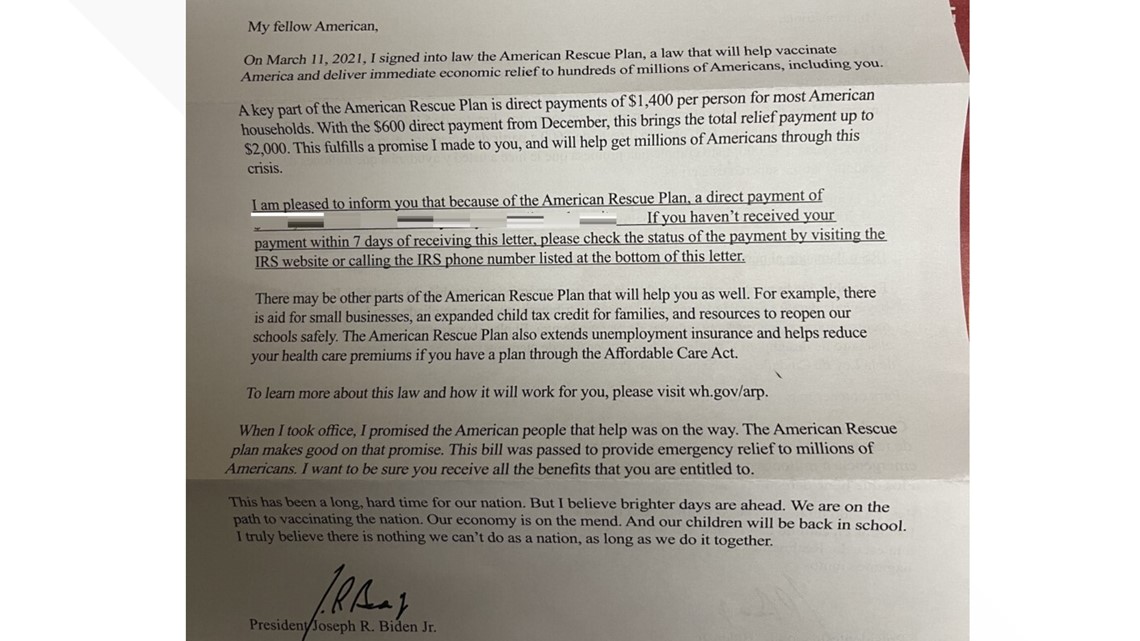

Stimulus Check Letter From President Biden Is Real 11alive Com

The Affordable Care Act (ACA) and Your Taxes The IRS has stated that highdeductible health insurance plans can cover the cost of COVID19 testing and treatment, before you have met your annual deductible This is not a mandate, but an option You should contact your own health insurance provider to find out if your plan will cover these expensesJul 17, · According to the U S Internal Revenue Service (IRS) Delinquent Collections Activities Data book, over 11 million Americans owed over $125 billion in back taxes

Tax Balance Due 3 Steps To Address Irs Notice Cp14 Tax Defense Network

Best Tax Filing Software 21 Reviews By Wirecutter

The Complete J1 Student Guide To Tax In The Us

Irs Says More Stimulus Checks On The Way But When Will Seniors Others On Social Security Get Covid Payments

What Do You Do If You Have Not Received Your 600 Stimulus Check Yet The Irs Offers Some Tips Kiro 7 News Seattle

3rd Stimulus Checks

Amazon Com Death Taxes And A French Manicure A Tara Holloway Novel Kelly Diane Books

I Don T Care Who The Irs Sends I M Not Paying Taxes的youtube视频效果分析报告 Noxinfluencer

Third Stimulus Check Update How To Track 1 400 Payment Status 11alive Com

Bogdanoff Dages And Co P C A Professional Tax And Accounting Firm In Indianapolis Indiana Tax Briefs

How To Get The Stimulus If You Live Abroad 3rd Payment Update Complete Guide To Economic Impact Payments For Us Citizens Overseas Cartagena Explorer

How To Get The Stimulus If You Live Abroad 3rd Payment Update Complete Guide To Economic Impact Payments For Us Citizens Overseas Cartagena Explorer

Tax Collection Privatization C Span Org

Cpa Partners Llc A Professional Tax And Accounting Firm In Seminole Florida Blog

What To Do If Your 1099 Should Have Been A W 2 Marketwatch

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

State Employees Credit Union Tax Refund Information

When To Expect My Tax Refund Irs Tax Refund Calendar 21

Japanese Who Received Biden Checks Should Return Them Says Irs Nikkei Asia

Irs Phone Number Stimulus Check Payment Status Questions Money

Is My Stimulus Payment Taxable And Other Tax Questions The Seattle Times

How To Find Missing Stimulus Payments From The Irs

Second Stimulus Check Irs Urges People To Watch Mail For These Envelopes Wfxrtv

Many Americans Cite Missing Stimulus Payments H R Block Turbo Tax Customers Experiencing Issues Kfor Com Oklahoma City

Turbotax It S Time To Check Taxes Off Your To Do List E File With Direct Deposit To Get Your Fastest Refund And Stimulus Check Intuit Me 348lc40 Facebook

Coronavirus Q A Will My Money Be Sent To The Wrong Address How To Stop Your Check From Going To The Wrong Account Abc7 San Francisco

I Don T Care Who The Irs Sends I M Not Paying Taxes Youtube

I Dont Care Who The Irs Sends I Am Not Paying Taxe Roblox Id Roblox Music Codes

Glitches Still Plaguing Stimulus Payments The Washington Post

Ahh Yes The World Renowned Mr George Hendricks Scams

Irs To Send Letter To 9 Million Non Filers Who Didn T Get Coronavirus Stimulus Cpa Practice Advisor

Fyi Your Federal Check Might Arrive As A Debit Card West Seattle Blog

Fyi Your Federal Check Might Arrive As A Debit Card West Seattle Blog

Bogdanoff Dages And Co P C A Professional Tax And Accounting Firm In Indianapolis Indiana Tax Briefs

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How To Avoid Scammers This Tax Season

Faq Regarding Stimulus Checks For Ssi And Ssdi Recipients Eparisextra Com

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

When To Expect My Tax Refund Irs Tax Refund Calendar 21

Stop Falling For This Phone Scam About Your Social Security Newscentermaine Com

Filing Taxes Do S And Don Ts For Professional Makeup Artists Camera Ready Cosmetics

The Wolf Man Episode Dan Vs Wiki Fandom

I Dont Care Who The Irs Sends Im Not Gonna Pay My Taxes Memes Gifs Imgflip

If You Re Still Waiting On Your 1 0 Stimulus Check Here Are Key Dates For The Next Set Of Payments Anchorage Daily News

Citizenship Based Taxation Who S Tried It Why The Us Can T Quit Nomad Capitalist

Irs Notice Irs Levy Letter Victory Tax Lawyers

Third Stimulus Check Updates Eligibility For Wednesday 3rd March 21 As Com

How To Pay Taxes To The Irs Online Check Or Credit Card

Refrance Explore Tumblr Posts And Blogs Tumgir

21 Child Tax Credit Who Qualifies For Monthly Payments

Glitches Prevent 1 0 Stimulus Checks From Reaching Millions Of Americans The Seattle Times

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

How Does The Irs Contact You Credit Karma Tax

What To Do When You Wrongly Receive A 1099 Nec Eric Nisall

Biden Plans May Not Ensure Fortune 500 Firms Pay Income Taxes Experts Say The Washington Post

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Irs Still Working On Last Year S Tax Returns May Extend 21 Tax Deadline Cpa Practice Advisor

I Don T Care Who The Irs Sends I Am Not Paying Taxes Youtube

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

Some Will Receive Second Irs Tax Refund In May Cpa Practice Advisor

How To Use Your Economic Impact Payment Prepaid Debit Card Without Paying A Fee Consumer Financial Protection Bureau

How To Get The Monthly Child Tax Credit If You Re Homeless

Don T Throw Out That Envelope With The Treasury Department Seal On The Outside Politics Magicvalley Com

Irs Notice Irs Levy Letter Victory Tax Lawyers

Identity Theft Wikipedia

Ask 2 Who Do I Contact If I Haven T Received My Stimulus Check

I Don T Care Who The Irs Sends I Am Not Paying My Taxes Youtube

The Wolf Man Transcript Dan Vs Wiki Fandom

Stimulus Check Update When Will You Get Your Second Payment

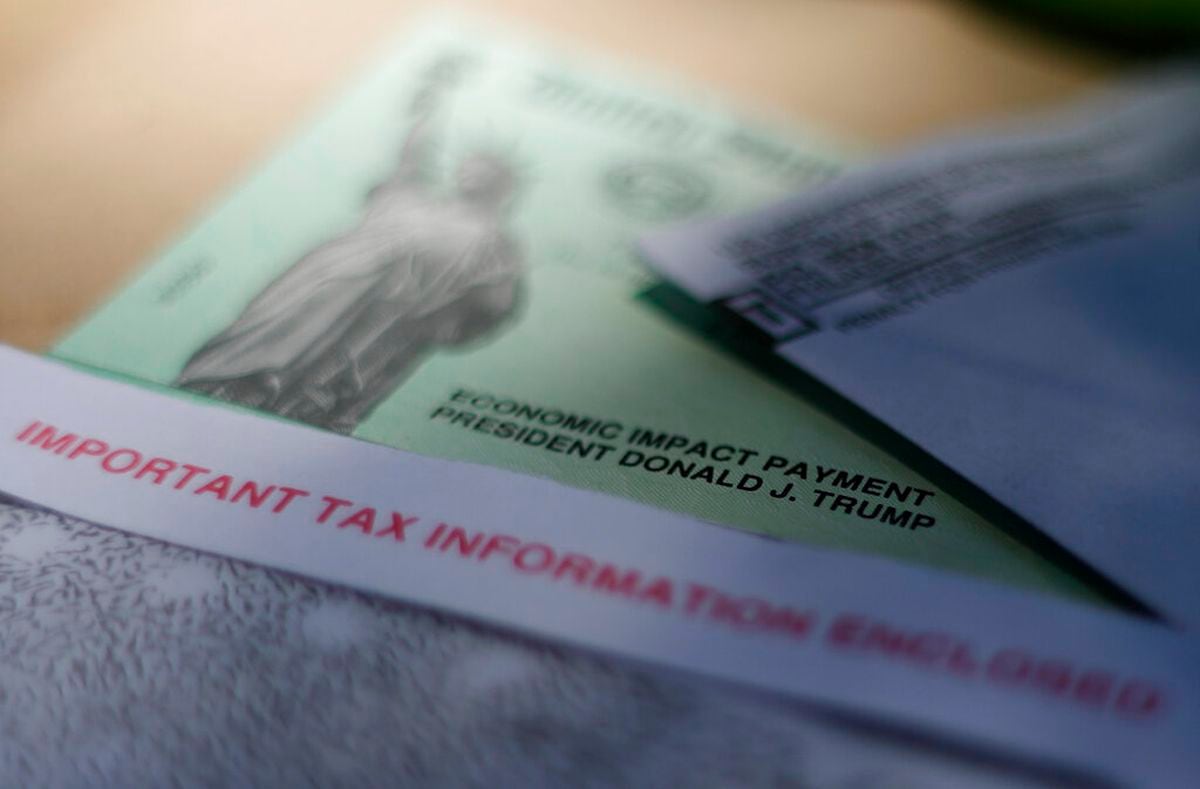

White House Stimulus Letter Is An Official Irs Tax Document You Need To Save Don T Mess With Taxes

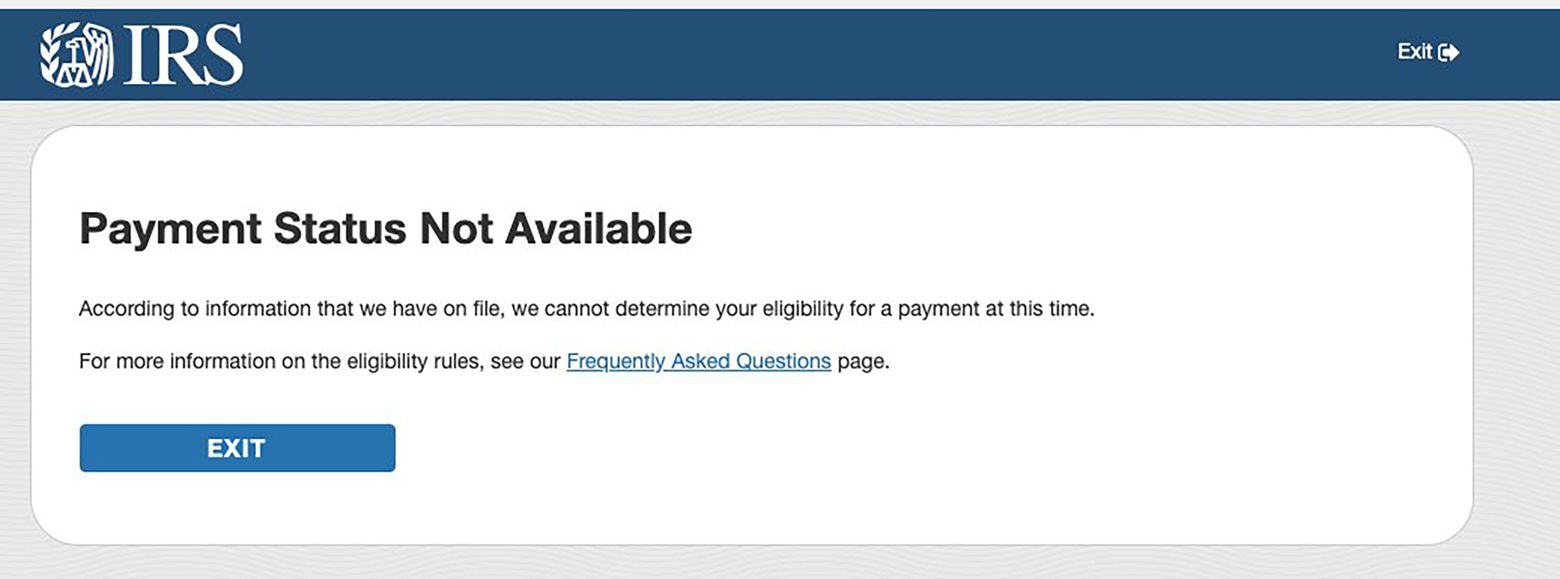

Irs Get My Payment Tool Lets You Track Your Stimulus Check

Jackson Hewitt Anticipates Tax Refund Shock Among Taxpayers Encourages Filing Early